On October 2020, Bill 145, Trust in Real Estate Services Act, 2020 was enacted and ultimately gave self-employed real estate agents the ability to incorporate and therefore, access to all the inherent benefits incorporating a business has to offer. This news made a stir in the real estate community as agents began to speculate how they could benefit from this maneuver and soften the burden of their annual encounter with the CRA. If you are in a circle within this community, you may have heard free flowing advice such as “setting up a PREC means your commission income will be taxed at a lower small business rate!” or “you will be able to split income with your spouse and kids!”. I am sure this advice had meant well, but it is partially true and created a headful of confusing questions surrounding the implications of incorporating.

This article will highlight and simplify the various factors that need to be considered when incorporating a real estate business and provide clarity to those that have received unsolicited but well intentioned tax planning advice from their ill-informed colleagues.

What is the main benefit of incorporating your real estate business?

You may have heard “tax deferral” before but are perhaps unsure of how this is different than “tax savings”. To understand this distinction, we need to know what “Integration” is (please bear with me for one minute). Integration is a fundamental structure to the Canadian tax code and is designed to ensure that business income earned personally or through a corporation is taxed at the same rate (or close to), thus leaving no immediate overall benefit to incorporating. However, when commission income is earned in a corporation, it is taxed in the corporation at the small business rate (first layer), then taxed again once the corporation pays out a dividend or salary to the shareholder/agent (second layer). And although the income has been taxed twice, the total tax expense will still equal the amount of tax the agent would have paid if they earned the commission income personally.

Now you may be asking, what if the corporation just defers dividends/salary paid to the shareholder/agent to avoid the second layer of tax for that year? If so, congratulations! You just discovered the tax-deferral benefits of setting up a PREC!

So this is how it works..

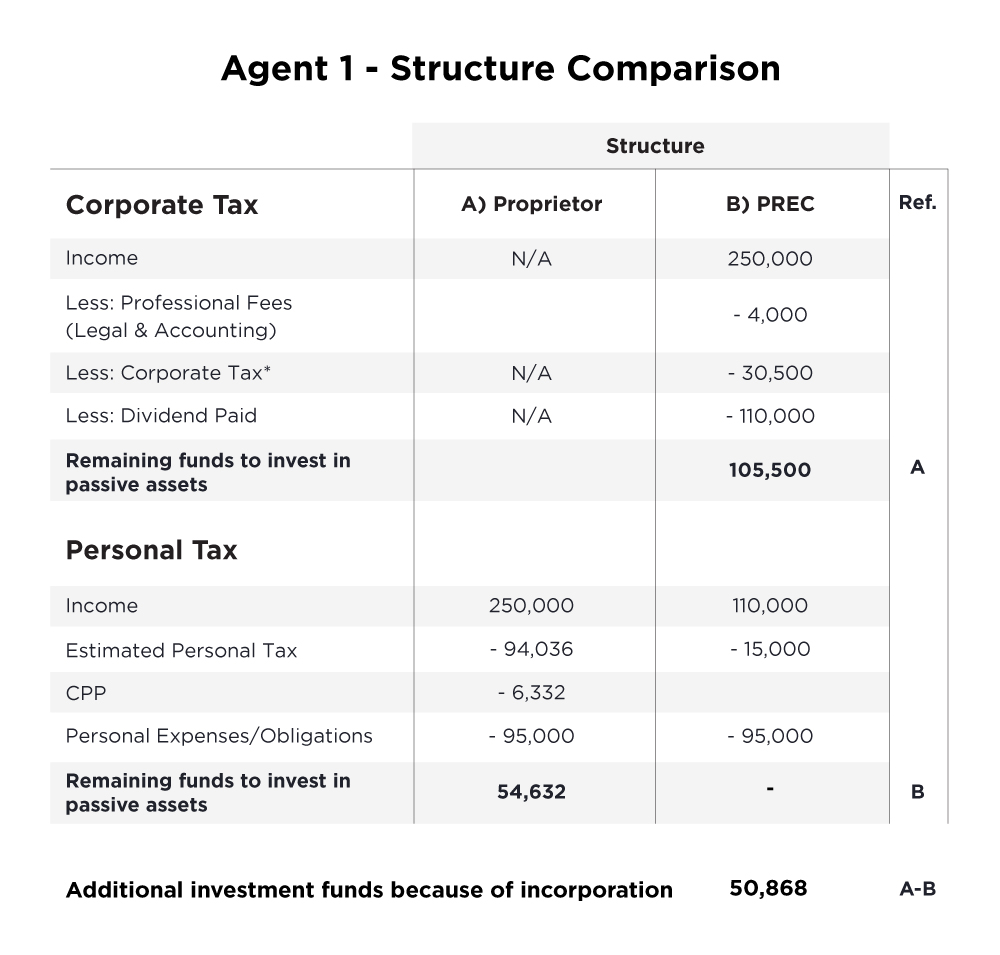

Let’s say agent has set up a PREC and has earned $250,000 in net commission income (after business expenses) and has personal living expenses (mortgage/rent, food, travel & entertainment, child care, ext.) of 95K.

The corporation would incur a tax expense (first layer) of $30,500 ($250,000 * 12.2% small business tax rate). And in order for the agent to pay their annual personal living expenses of $95,000, they would have to pay themselves an annual dividend of $110,000 which would result in $15,000 in personal tax expense (110K Dividend – 15K Tax Expense = 95K in funds available to pay personal living expenses).

Since the corporation only paid enough in dividends to satisfy the agent’s personal spending requirements, there are $109,500* in funds left over in the corporation to invest in assets such as rental properties, personal pension plans, life insurance policies and so on.

To contrast this, if the agent had not incorporated and earned 250K in net commission income personally, they would have paid approximately $100,000 in tax and Canadian Pension Plan contributions (CPP) on this income and only be left with $55,000 to invest after their personal spending requirements.

As a result, the agent is left with $50,868* more in additional funds to invest in as a result of incorporating!

*Exhibit 1 – Sole Proprietorship VS. Personal Real Estate Corporation

What are the secondary benefits?

Canadian Pension Plan Flexibility

Self-employed real estate agents who are not incorporated must pay the employee and employer share of Canadian Pension Plan (CPP) contributions on their self-employed commission income. Assuming an agent makes at least $61,600 per year, this will result in annual CPP contributions of $6,332. However, if the agent incorporates and pays themselves a dividend instead of a salary, there is no longer a requirement to contribute to CPP and the agent will be left with an additional $6,332 in funds to invest.

Access to Lifetime Capital Gains Exemption

Assuming that you have built a successful real estate business with an active market of agents interested in acquiring it, incorporating may allow you to take advantage of the lifetime capital gains exemption upon sale of the corporation. As of 2021 this could result in $892,218 in capital gains exempt from tax. So for example, if you sold your business for a purchase price below this amount, the entire transaction may be tax free!

What expenses are incurred as a result of incorporating?

Should you decide to incorporate, there will be annual administration and compliance costs associated with producing financial statements and preparing a corporate tax return. There will also be non-recurring professional fees incurred for setting up your PREC and brokerage agreement and transferring assets (if any) into the corporation, along with annual legal fees related to preparation and maintenance of the corporation’s minute book. See the below estimate of annual professional fees required to maintain your PREC:

Financial Statements & Corporate Tax Return: $2,000-2,500

Annual Bookkeeping: $750-1,500

Legal Fees:$300-500

Total: $3,050-$4,500

What an idea candidate for a PREC looks like

The general test to see if setting up a PREC is right for you and can be simplified in the following equation:

IF: Additional funds available to invest as a result of incorporating (Refer back to Exhibit 1 for calculation) >=$10,000

THEN you are likely an idea candidate for a PREC! Logically, I imagine that your next question is “how do I know if incorporating would provide me with additional funds to invest in?”. Well this depends on your annual income, marginal tax rate, and personal spending however, if you follow the calculation approach in Exhibit 1 you will be able to determine this yourself (assuming you use the correct tax rates). If that seems like too much work reach out to me, Taylor Roberts, CPA and I will help as part of a free consultation!

For those looking to gain a deeper understanding of the $10,000 threshold mentioned above, continue reading, and for those who could not be bothered, I do not blame you and please skip the rest of this section.

Quantifying the financial cost or benefit of incorporating requires some assumption making on investment returns and timelines however, it can be determined by comparing the projected return you earn on additional funds available for investing to your projected annual professional fees, which we can assume to be $4,000 annually.

To put this $10,000 threshold test above into perspective, let’s assume there are $10,000 in funds available for investing as a result of incorporating and they are invested in portfolio earning 6% per year for 10 years. The initial $10,000 investment will turn into $17,900, generating a return of $7,900 to be received 10 years from now. Since we have to factor in the time value of money (a dollar tomorrow is worth less than a dollar today), a financial calculator will tell us that the present value of $7,900 ten years from now is $4,400. Since this amount is greater than our projected annual professional fee costs of $4,000, then it is clearly worthwhile to incorporate!

Of course, there are other factors that need to be considered when setting up a PREC such as RRSP contribution room so make sure you consult a qualified CPA before doing so.

Is it true you can use a corporation to split income?

Yes, but to a limited extent and if very specific criteria are met. Since CRA introduced the new Tax on Split Income (TOSI) rules in 2018, splitting income has become more difficult as family member recipients of the split income are required to reasonably contribute to the business. In regards to PREC’s which are primarily service based business, a reasonable contribution means at least a 20 hour per week contribution. In the event that a family member has contributed to the business but does not meet the 20 hour per week threshold, reasonable wages can be paid through payroll.

Any further questions?

Please reach out to Taylor Roberts, CPA and he would be glad to offer a free initial consultation to any real estate agent considering incorporation.