Not even accountants can all agree whether claiming CCA on a rental property is generally a good idea. It certainly has its benefits, but at what cost? This article is designed to outline the decision-making process and considerations one should apply when making this decision.

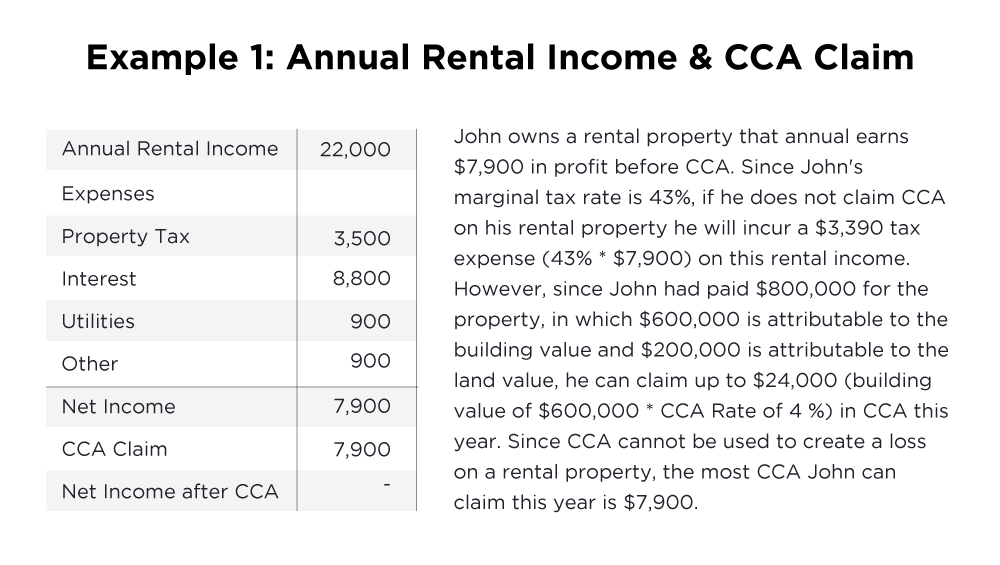

At first glance, claiming Capital Cost Allowance (CCA) on a rental property may seem like a good way to reduce your annual tax expense however, it is important to consider the potential consequences of doing so when you sell the property. To illustrate, let’s walkthrough an example:

At this point, John has saved $3,390 in tax expense so claiming CCA may seem like a “no brainer” however, let’s fast forward another 15 years to the point in time in which John finally sells the property and has to report all prior CCA claims as income due to a concept called “Income Recapture”. Income recapture results when an asset with prior CCA claims against it is sold for an amount greater than the undepreciated capital cost (UCC) of the asset. Assuming John claimed $7,900 in CCA in each of 15 years he owned the property, the UCC of his rental property would be $481,500 ($600,000 building value – $7,900 annual CCA claim* 15 years). Like most real estate investments, the building and land values of John’s rental property had increased substantially and as a result, John had sold his building for well above its original cost of $600,000 and is now required to report all prior CCA claims of $118,500 ($7,900 * 15 years) as income. Since John is now in the highest marginal tax rate as a result of the capital gain realized on the sale of this property, he will have to pay tax of $63,390 (53.5% highest marginal tax rate * Income Recapture of $118,500). The calculation below compares the tax savings of claiming CCA throughout the holding period to the tax expense arising from income recapture and demonstrates that claiming CCA creates an additional $12,540 in overall tax expense.

Calculation:

Annual CCA Claim $7,900

Marginal Tax Rate 43%

Annual Tax Savings 3,390

Year of Ownership 15

Total Tax Savings from CCA claims 50,850

Total Tax Expense from Income Recapture 63,390

Cost of claiming CCA (12,540)

However, what if throughout this holding period John has an opportunity to participate in high yielding investments but does not have enough cash? By claiming CCA, John could free up additional capital and earn a return that would make the income tax expense on the eventual income recapture worthwhile. This is why there is never a one size fits all approach to claiming CCA on rental properties and stresses the importance of discussing such decisions with a qualified CPA.

Lastly, there are also implications when claiming CCA on a rental property that used to be your principal residence within the past 4 years. If you move out of your principle residence and begin renting another property or perhaps even temporarily moving out of the country, you can claim the property you rent out as your principle residence for up to 4 years. This election is ONLY available if you have not claimed CCA on the property and allows you to move back into the home within this four year period with no tax consequences.